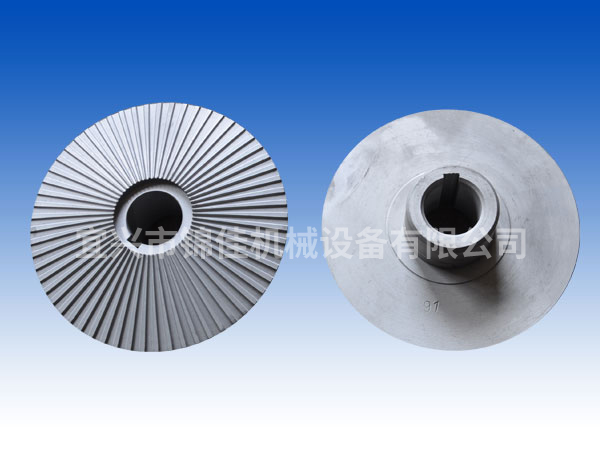

锦佳机械 · 产品信息

JINGJIA MACHINERY PRODUCTS

![]()

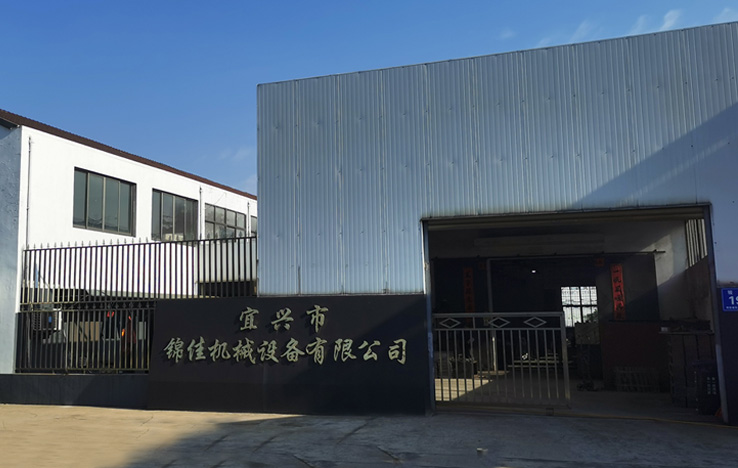

宜兴市锦佳机械设备有限公司

宜兴市锦佳机械设备有限公司坐落于风景秀丽的太湖之滨“中国陶都”—宜兴,环境优美,凯时彩票网便利。

凯时彩票网是生产齿链式无级变速器、变速链条的专业厂家,企业拥有较雄厚的技术力量,制造设备精良,凯时彩票网手段,对传动机械有较完整的探索和研究。经验丰富,产品质量上乘,畅销全国各地,深受用户好评。目前已凯时彩票网成P0~P6七大功率系列2700多种调速比和安装形式。产品广泛应用于凯时彩票网、纺织、丝绸、食品、造纸、印刷、卷烟、矿山、包装、化工凯时彩票网及工业流水线等机械传动设备。并随机出口东南亚凯时彩票网和地区,是上述行业机械设计和配套的合适选择。

我们企业的信条是:质量上乘、信誉至上、客户至上。

锦佳机械· 生产车间

JINGJIA MACHINERY WORKSHOP

![]()

生产车间

生产车间

生产车间

生产车间

锦佳机械 · 新闻资讯

JINGJIA MACHINERY NEWS

![]()